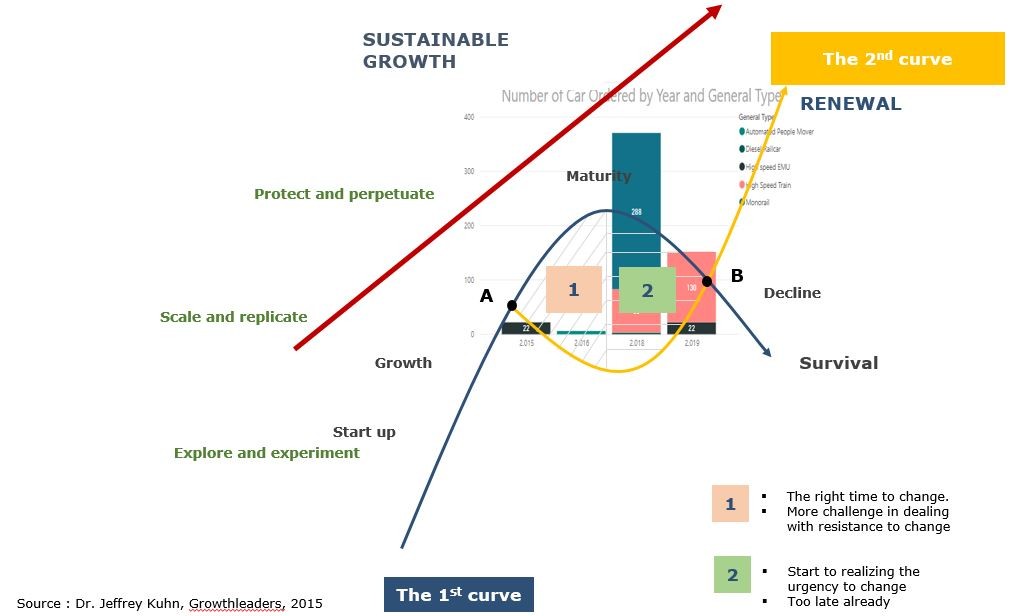

In a rolling stock manufacturer industry. It is paramount to figure out the maturity of its product. Fail to do so, will affect the continuity of the company, either late to follow the development of the technology or sticking to develop the technology that has no future on the market. Sure, there will always debate on should a company follow a trend or create a trend. but this will easily be solved by knowing the position among the competitors. One of the types of analysis that can help to determine the maturity of products is the S-curve analysis.

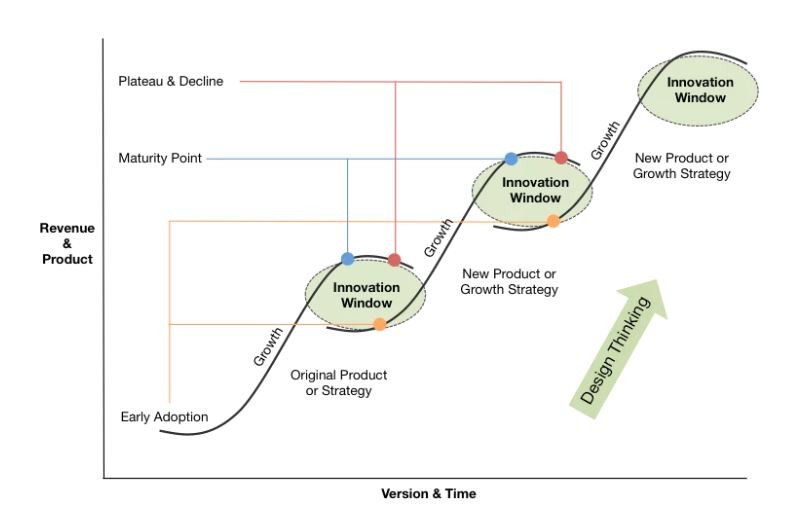

The S-Curve Pattern of Innovation highlights the fact that as an industry, product, or business model evolves over time, the profits generated by it gradually rise until the maturity stage. As a product approaches its maturity stage, a business should ensure that it has new offerings in place to capture future profit opportunities. These new products are often upgraded or related versions of products approaching the maturity stages of their S-Curves.

If an organization can pinpoint its position on the life cycle curve (S-curve), and it has a sense of the slope of the curve, it has an excellent mechanism for determining where its technology is headed. Furthermore, the organization can determine the relative rapidity of that movement. This type of information along with relevant external sources and comparisons to similar offerings in the past can be used to predict when an s curve will reach maturity.

But, the trend that is to be plotted on the graph in a broad portfolio industry and also has a specific serviceable market has to be specified first, based on the product type and its market.

In this report, the numbers plotted will be the number of volume of car ordered. in a price-sensitive market. So, let’s start.

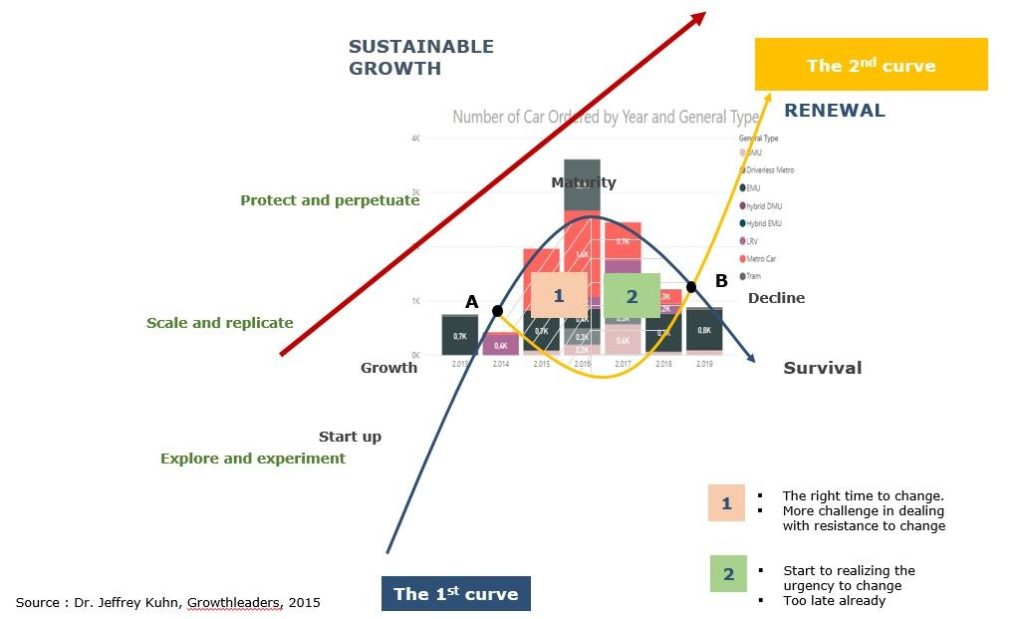

The volume of a self-propelled car ordered on the price-sensitive market.

First, the self-propelled car, which its type is consists of DMU, Driverless Metro, EMU, hybrid DMU, hybrid EMU, LRV, Metro Car, Tram. based on this, it is clearly seen that the self-propelled car is already at the maturity level and even going into the declining phase. But this cannot be interpreted that this product will be obsolete due to only of its technology. The driver of this market growth neede to be explored to get what really happened. it could be that the demand for this type is already filled, and no longer need another fleet, or fleet is needed but the funding is still unavailable. But, for the sake to keep this report concise, we will keep the report as it is, without further drill-down on what’s really going on in this matter.

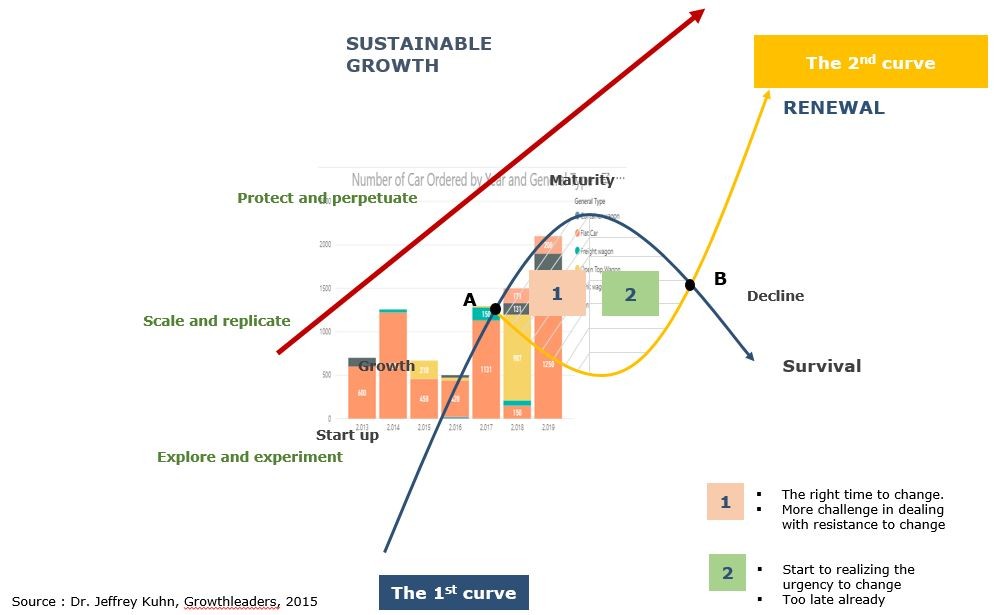

The volume of a freight wagon car ordered on the price-sensitive market.

Second, the freight wagon, which its type is consists of Container wagon, flat car, open-top wagon, tank wagon, van, and unidentified freight wagon. Based on this plot, it is clearly seen that the freight wagon is still on the growth phase with no identification that it will move to maturity level just yet. It seems that in a price-sensitive market, driver to order new rolling stock, still focus on supplying the logistic fleet. And the demand for this type of fleet still has some potential, but it needs to be clear that in a price-sensitive market, funding is still an issue. without funding the need of this, will not be realized. And that previous statement backed up by the following graph

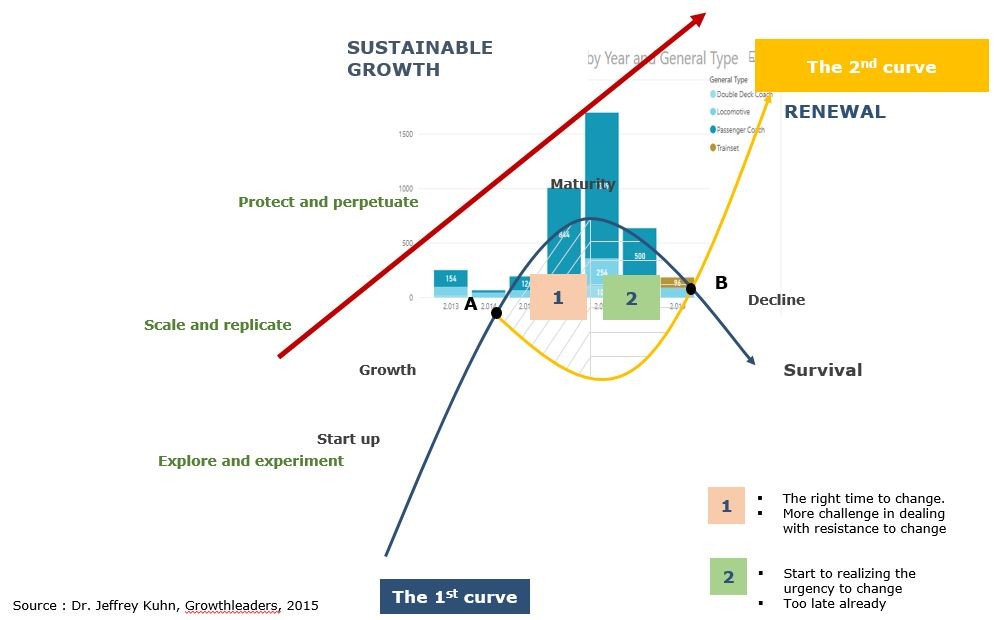

Third, we can see that the number of passenger coach ordered in a price-sensitive market is showing a declining phase. And yes, the need to increase the fleet for passenger traffic seems like still not a priority in this kind of market. Moreover, a special car type, as shown as follows:

Another analysis needs to be done, in order to figure out what is really happening in the decline of rolling stock car ordered in a price-sensitive market. for example a BCG matrix and else. But let’s keep it for another time.

Author :

Author :

Mr. Bedy Kharisma

Market Research and Development

of Railway Industry

This article is a part of our July 2019 Magazine. If you would like to subscribe , Click Here to subscribe .